Labuan Tax

Labuan tax treatment able a Labuan entity to avail itself of treaty benefits. In compliance with international taxation standards, a Labuan entity is subject to tax under Labuan Business Activity Tax Act 1990 (LBATA), and supplemented by parallel Labuan legislation for Labuan companies and trust.

Annual Tax Return needs to be filed with the Malaysian Director General of Inland Revenue by 31st March of that year of assessment.

At Law & Commerce, we assist in the preparation and submission of companies’ annual tax return submission to the Inland Revenue Board of Malaysia (IRB) for our clients.

Economic substance regulation (ESR) requires Labuan entities undertaking Labuan business activities to demonstrate that they carry out substantial economic activities in the jurisdictions, in accordance with the Labuan Business Activity Tax Act 1990 (Act 445)

The Labuan entities, as specified in the list shall, for the purpose of Labuan business activity have:

(i) an adequate number of full time employees in Labuan; and

(ii) an adequate amount of annual operating expenditure in Labuan,

as prescribed by the Minister by regulations made under this Act.

The number of full time employees (FTE) and annual operating expenditure (OPEX) varies depending on the type of business activity.

Non-fulfillment of the required ESR, will eliminate a Labuan entity from qualifying for the minimum tax rate of 3% for Trading entities; or 0% for Non-Trading entities.

The full list of Labuan ESR based on business activity can be referred here.

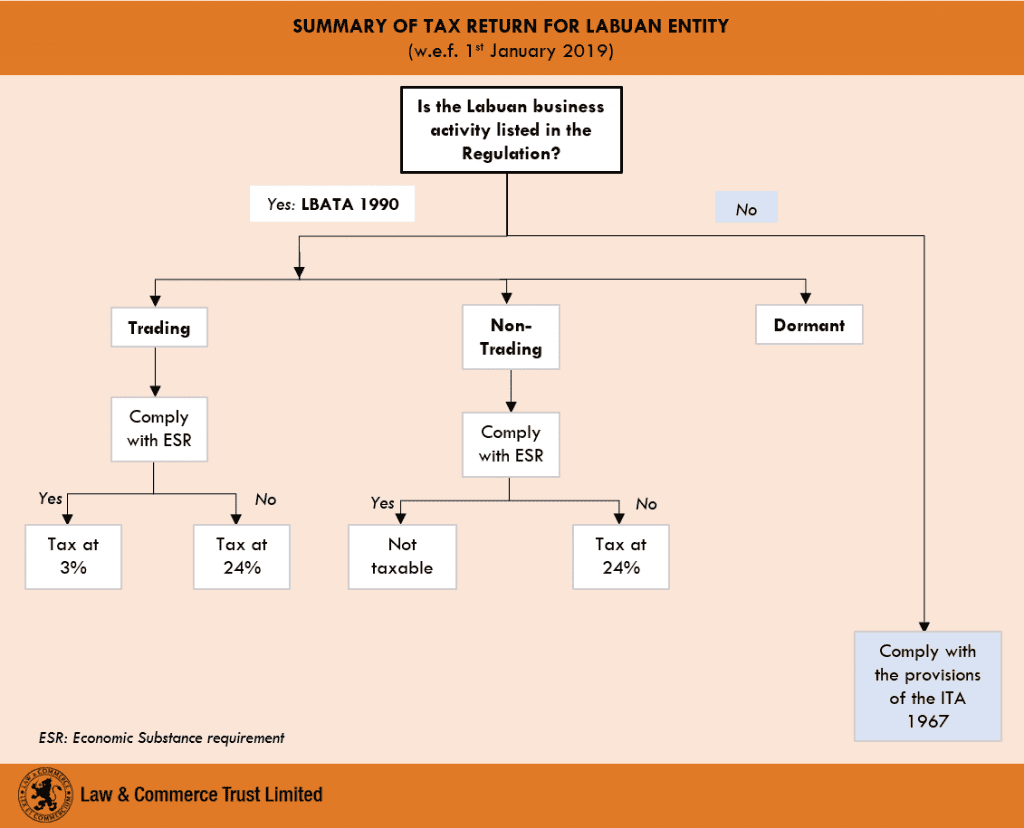

A Labuan entity must carry out a business activity that is listed in the Substance Requirements [PU(A) 392 of 2018] for it to come under the ambit of LBATA.

The list of business activities are as follows:

| Trading | Non-Trading |

|

1. Labuan insurer, reinsurer, takaful and retakaful; 2. Labuan underwriting manager or underwriting takaful manager; 3. Labuan insurance manager or takaful manager; 4. Labuan insurance broker or takaful broker; 5. Labuan captive insurer/takaful; 6. Labuan international commodity trading company; 7. Labuan bank/investment bank/Islamic bank/Islamic investment bank; 8. Labuan trust company; 9. Labuan leasing or Islamic leasing; 10. Labuan credit token or Islamic credit token company; 11. Labuan development finance company or Islamic development company; 12. Labuan building credit or Islamic building credit company; 13. Labuan factoring or Islamic factoring company; 14. Labuan money broker or Islamic money broker; 15. Labuan fund manager; 16. Labuan securities licensee or Islamic securities licensee; 17. Labuan fund administrator; 18. Labuan company management; 19. Labuan international financial exchange; 20. Self-regulatory or Islamic self-regulatory organisations 23. Other trading entity — Labuan entity that carries out administrative, accounting and legal services including backroom processing, payroll services, talent management, agency services, insolvency related services and management services. |

21. Labuan entity that undertakes investment holding activities other than pure equity holding activities; 22. Labuan entity that undertakes pure equity holding activities. |

Note: There is still uncertainty and ongoing dialogue on the treatment of category 23. It is best that tax agent advise be obtained if your intended business come under this category.

If your company is a trading company, it is liable to pay 3% or 24% tax on net audited profit – depending on whether the required substance regulation is met. It is a requirement for a trading company to maintain adequate financial records, as well as to have their account audited for tax submission.

For non-trading company, the tax rate is either 0% (not taxable) or 24% of the audited profit (if substance regulation is not complied).

However if the Labuan entity carries a business activity that is not listed in the regulation, tax filing has to be done under Income Tax Act 1967 (ITA) instead of Labuan Business Tax Activity Act 1990. An appointment of a tax agent is required for filing under this Act.

Summary of tax return for Labuan entity:

ACCOUNTING & AUDIT

Perhaps one of the areas which is most commonly overlooked and often neglected is the requirement to prepare accounting records and where applicable to audit the company’s accounts. In most cases even if a company is not required to pay tax under the prevailing laws there will normally be a requirement that the company prepares or maintains account which can clearly demonstrate the company’s financial position. Not to do so not only may amount to non-compliance but also compromise the company’s standing.

From our experience accounting work is rarely expensive and we work with a number of qualified accountants to provide accounting services to your company.

Through our network of qualified accountants, we can offer weekly, bi-weekly, monthly or yearly accounting regular reporting services. Our accounting services covers all aspects of accounting and bookkeeping, including:-

- Entry of transactions.

- General Ledger.

- Assets /Equipment Ledgers.

- Expenses Ledger.

- Accounts Receivables.

- Accounts Payables.

- Ageing Report & Summaries.

- Bank Reconciliation.

- Financial Statements Preparation.

- Trial Balance.

- Income Statement (Profit & Loss).

- Balance-sheet.

- Cash Flow Statement.

- Periodic/Annual Reports.

The accountants are familiar with most industry standard software applications, and if required, we can work with other applications also. With our knowledge and experience in Bookkeeping and Accounting procedures we provide our service for all your Bookkeeping and Accounting needs, whether computerized or manual.

We also work with a few well-established audit firms through which speedy and cost-effective auditing may be performed. If you require our recommendation of Labuan approved auditors, please do not hesitate to contact us.

Accounts & audit: A Labuan company must keep its financial records which clearly show its financial position. This would mean keeping accounts up to trial balance at least. As per Labuan FSA, a Labuan company must maintain proper accounting and other records in Labuan. These proper accounting and other records shall be kept at the registered office and shall be open at all times for inspection. A copy of an audited account shall be lodged with the Authority within certain period.

Appointment of auditor: If your company is a trading company, or a non-trading company that does not comply with the required substance, an auditor must be appointed. This auditor must be “a Labuan approved auditor” as listed by Labuan FSA, which could be recommended on your request.

A Labuan company is now allowed to elect to be taxed under the ITA 1967 and pay tax at the rate that varies according to the year of assessment and the company’s paid up capital. This will enable the company to derive benefits from Malaysia’s numerous DTTs.

This election is irrevocable and if made will subject the company to all provisions under the ITA. Customers are advised to seek proper international tax advice before implementing this tax structure.

For companies that wish to elect for tax under ITA, an appointment of tax agent is required.

Summary of Tax, Accounting and Audit

| Taxing statute | Tax rate | Payment deadline | Is account required? | Filing of account to IRB | Filing of account to Labuan FSA | |

|---|---|---|---|---|---|---|

| Labuan Trading entities | LBATA 1990 | 3% or 24% | On or before 31st March every year | YES | YES | YES |

| Labuan Non-Trading entities | LBATA 1990 | 0% or 24% | On or before 31st March every year | YES | YES for 24% | NO |

| Labuan entities electing for ITA 1967 | ITA 1967 | Tax rate varies with year of assessment and company’s paid up capital | Advance tax payable monthly | YES | YES | YES/NO |

For a better understanding or clarification regarding the the tax return, accounting or audit requirement, please do not hesitate to contact our team.